Feb 28 2024

The early days of e-commerce on the internet resembled a digital Wild West, characterized by unencrypted form inputs and clear-text storage of sensitive information. Fast forward to today, and the landscape of online payments has transformed dramatically, bolstered by industry-driven guide rails like the Payment Card Industry Data Security Standard (PCI DSS). These standards ensure that consumer details are stored appropriately and handled with the utmost care and security.

As digital infrastructures continue to evolve and deployments grow in complexity, OpenTelemetry has become an essential tool as part of the tech stack for modern deployments. Its widespread adoption shows the growing need for robust, scalable observability solutions that can adapt to the multifaceted architectures of today’s applications. OpenTelemetry provides real-time insights into system performance and security postures, making it an invaluable ally in complementing and enhancing PCI DSS compliance efforts.

This post is going to look at some of the ways that OpenTelemetry can aid in helping keep your deployments as secure as possible.

Understanding PCI DSS and Its Importance

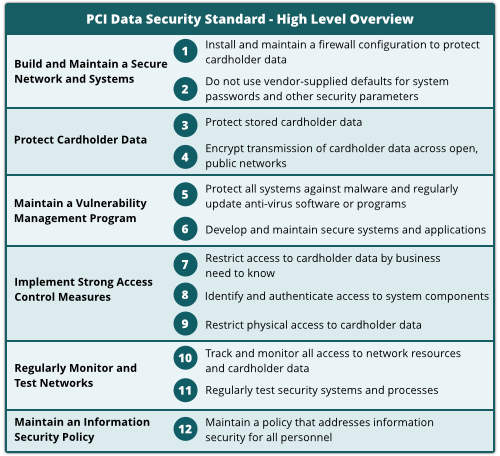

The Payment Card Industry Data Security Standard (PCI DSS) is a globally recognized set of security standards designed to ensure that all companies that handle credit card information maintain a secure environment. This comprehensive standard is mandatory for any organization that processes, stores or transmits payment card data to reduce credit card fraud through increased controls around data and its exposure to compromises.

PCI DSS is not just about IT security; it’s about protecting the payment ecosystem as a whole. In an era where data breaches are common, adhering to these standards is crucial for safeguarding sensitive payment card information against unauthorized access and theft. The guidelines set forth by PCI DSS help establish a strong foundation of secure practices, including encryption, access control, and vulnerability management.

For companies, compliance with PCI DSS is not optional if they wish to accept payment cards. Beyond the regulatory aspect, companies have compelling reasons to adhere to these standards. Firstly, compliance helps build customer trust, reassuring them that their card information is handled securely. This is critical in today’s digital marketplace, where consumer confidence can significantly impact purchasing behavior.

The Role of OpenTelemetry in Navigating PCI DSS Requirements

OpenTelemetry, a comprehensive observability framework, is pivotal in aligning with PCI DSS by enhancing system transparency and security through metrics, traces, and logs. Here’s how OpenTelemetry aligns with specific PCI DSS requirements:

PCI DSS Requirement 1: Secure Network

Requirement: Establish and maintain network security controls to protect cardholder data.

How OpenTelemetry Helps: OpenTelemetry can monitor network traffic and firewall efficacy, ensuring robust perimeter defences. For instance, a financial institution could use OpenTelemetry to detect unusual spikes in traffic that may indicate a breach attempt, enabling rapid response to potential threats.

PCI DSS Requirement 3: Protect Stored Cardholder Data

Requirement: Ensure that stored cardholder data is adequately protected with encryption and other measures.

How OpenTelemetry Helps: OpenTelemetry’s tracing capabilities can visualize the journey of cardholder data across systems, ensuring encryption is consistently applied. A retail company, for example, could use OpenTelemetry to trace the data flow within its payment processing system, identifying unencrypted touchpoints for remediation.

PCI DSS Requirement 6: Secure Systems and Applications

Requirement: Develop and maintain secure systems and applications to protect cardholder data from vulnerabilities.

How OpenTelemetry Helps: By integrating OpenTelemetry’s logging with vulnerability management tools, organizations can pinpoint and address security weaknesses. A case in point could be an e-commerce platform leveraging OpenTelemetry logs to identify and patch a SQL injection vulnerability in its payment gateway.

PCI DSS Requirement 7: Restrict Access to Cardholder Data

Requirement: Limit access to cardholder data to only those individuals whose job requires such access.

How OpenTelemetry Helps: OpenTelemetry can provide detailed audit trails for access control, ensuring compliance with the principle of least privilege. For example, a payment processor might use OpenTelemetry logs to audit access to sensitive databases, ensuring only authorized personnel can view cardholder data and that sensitive data is correctly masked within system logs.

PCI DSS Requirement 10: Monitor and Track Access

Requirement: Monitor and track all access to network resources and cardholder data to detect and respond to security incidents.

How OpenTelemetry Helps: OpenTelemetry supports real-time monitoring and alerting for unusual access patterns or potential security incidents. A bank, for instance, could employ OpenTelemetry to monitor access logs for its cardholder data environment (CDE), quickly identifying unauthorized access attempts.

PCI DSS Requirement 11: Regularly Test Security Systems

Requirement: Test security systems and processes regularly to identify vulnerabilities and ensure the effectiveness of security measures.

How OpenTelemetry Helps: The framework’s ability to aggregate and analyze telemetry data can aid in proactive security testing and risk assessment. A payment service provider could use OpenTelemetry metrics to conduct performance and security testing on its infrastructure, ensuring it can withstand attack scenarios.

Integrating OpenTelemetry into Workflow and Development Toolchains

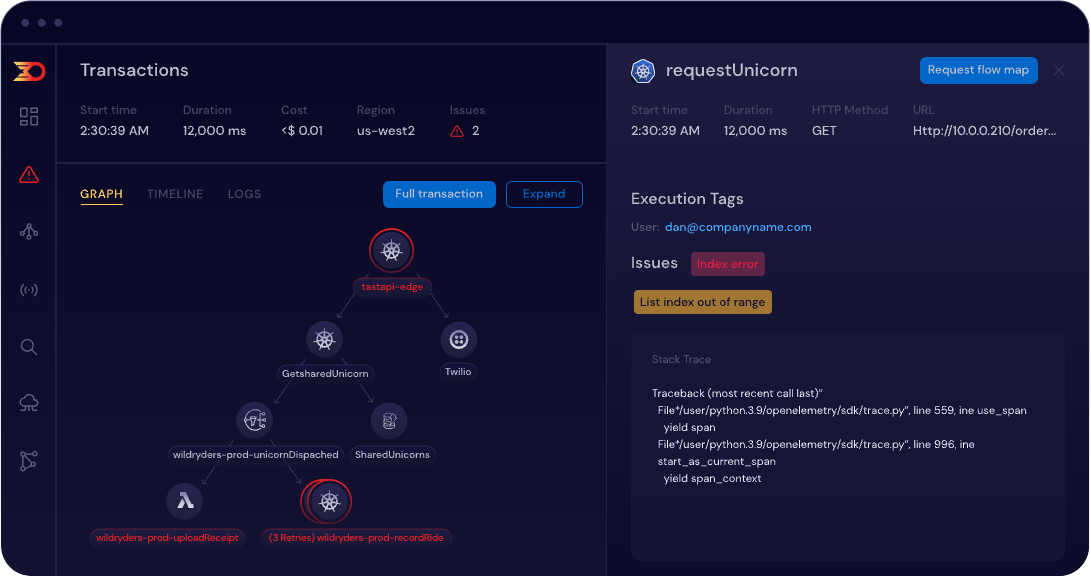

Integrating OpenTelemetry into your development and operational workflows significantly enhances visibility and monitoring capabilities, but it often comes with the challenge of implementation overhead. This is where Lumigo’s implementations come into play, seamlessly enhancing your toolchains by leveraging auto-instrumented OpenTelemetry. Lumigo simplifies the integration process, allowing teams to focus on deriving valuable insights rather than grappling with the complexities of manual instrumentation.

The Lumigo Kubernetes operator is a great example of how simplicity and efficiency can be achieved in observability, with it literally being installed by a few lines of helm and a Yaml manifest. The best part is by using this operator, you can deploy OpenTelemetry instrumentation across an entire Kubernetes namespace. This process requires no manual intervention or code changes, which means that all your deployments within the namespace will be instrumented as soon as a runtime is recognized.

Incorporating Lumigo in your OpenTelemetry strategy provides you with the robust observability of OpenTelemetry as well as Lumigo’s plethora of features, including automated alerts and a see performance optimization opportunities on your deployed component nuances. This combination ensures that your deployments are not only kept in great shape but have the necessary tools to maintain high-performance standards, quickly resolve issues, and continuously improve your applications and services, all while adhering to security and compliance standards like PCI DSS.

See How OpenTelemetry can help with your PCI requirements

Although PCI DSS provides a comprehensive framework for securing cardholder data, implementing its guidelines effectively can be challenging, and ongoing monitoring can be exhaustive. By implementing OpenTelemetry, you can track transactional data securely. However, it is vital to take the right approach to implementation to ensure secure deployment. This is where Lumigo comes in, not only automating and enhancing observability but also providing clearer insights and more actionable data from your OpenTelemetry deployments.